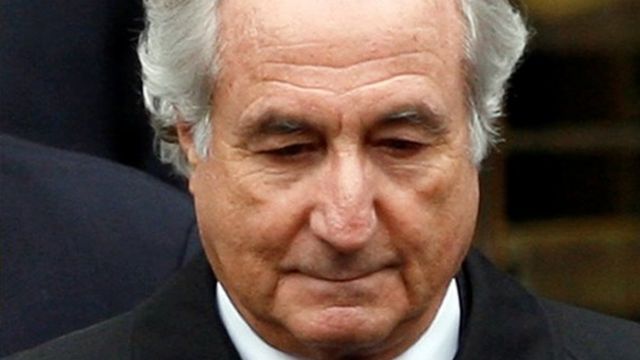

The $ 65 billion scam that broke investors and led to the arrest of Bernie Madoff, who died on Wednesday

Bernie Madoff has always strived to maintain an aura of exclusivity around his business

Financial trader Bernie Madoff, who was convicted of the biggest financial fraud in the history of the United States, died in prison at the age of 82. The cause was not disclosed.

Madoff had been sentenced to 150 years in prison in 2009, after admitting that he set up a $ 65 billion pyramid scheme and collapsed during the 2008 financial crisis.

His company came to be investigated eight times by the United States Securities and Exchange Commission (SEC, the acronym in English), the agency that oversees this market, because he had obtained exceptional gains.

But it was the global recession that effectively brought Madoff to ruin after nearly 50 years of Wall Street operations.

When his investors were hit by the crisis, they tried to withdraw about $ 7 billion from his investment funds, and he was unable to cover these withdrawals.

Fraud has caused a huge loss for companies, banks and citizens

Madoff's list of victims includes film director Steven Spielberg's charitable foundation, Wunderkinder, banks like HSBC, Royal Bank of Scotland and Santander, and other investment firms like England's Man Group and Nomura Holdings, from Japan.

Teachers, farmers, mechanics and many other ordinary citizens have also lost all of their savings. At least two people committed suicide because of this.

"We think he was God. We trust everything in his hands," said Nobel Peace Prize winner Elie Wiesel, whose foundation lost $ 15.2 million in 2009.

To date, only a fraction of the $ 65 billion involved in Madoff's scheme has been recovered.

Aura of exclusivity

The son of an Eastern European immigrant couple, Bernie Madoff was born and raised in New York.

He started his career in the financial market at the age of 22, with $ 5,000 he had earned while working during his summer vacation as a garden sprinkler installer.

He created Bernard L. Madoff Investment Securities in 1960. The company became one of the most responsible for the formation of this market in the United States, by bridging the gap between those who buy and those who sell shares. Madoff was also chairman of the Nasdaq stock exchange.

Madoff was described as "affable" and a "high-level but discreet" person. He has always endeavored to maintain his aura of exclusivity.

Many of his wealthiest customers were won over in club conversations with the wealthiest in New York or Florida. Madoff gave them a sense of belonging to a privileged circle.

He used these big names to attract other investors, until his influence spread to large banks, funds and even charitable organizations.

Obscure operations

Authorities were charged for not having detected the scheme

As one of the largest investors in the world, Madoff managed about $ 17 billion with his company.

But, according to the complaint made by the United States attorney general, he reportedly told employees that the company had been insolvent for years.

No one seems to know for sure what has happened to all the money involved in Madoff's scam since the early 1990s.

To the American Federal Public Ministry, he would have said that he had "absolutely nothing".

Their operations were in fact quite obscure. In addition to his original company, he ran a completely independent financial advisory firm.

He never revealed his methods of operating on the market or how he generated substantial profits for the investors he represented.

In good or bad times, he was able to pay 10% or more of profitability every year. "It is a strategy of my business. I cannot give too many details," he said once.

Investigations pointed out that the "business strategy" was to use money from new investors to pay dividends to older ones. Known in the market as a financial pyramid scheme, this form of operation is unsustainable in the long run and, above all, illegal.

Madoff confessed his crimes to his two children when everything started to fall apart. They reported him to the police, who arrested him the next day, on December 11, 2008, while covering Manhattan.

Regulatory loopholes

Madoff pleaded guilty and apologized to his victims

But how did this situation not raise suspicions by regulators before?

The answer probably involves a combination of Madoff's personal prestige and his careful exploration of certain loopholes in the system.

As a former president of Nasdaq, with a collection of other boards on the curriculum, and a generous donor to charitable causes, he was a man who inspired confidence.

As for regulators, the SEC regularly inspected Bernard L. Madoff Investment Securities, but not its financial advisory firm, which managed a hedge fund.

Hedge funds are more speculative and riskier investments than conventional financial products, but they often bring higher returns.

This Madoff fund was not registered with the SEC until September 2006 and which, according to reports, was never subject to inspection after that.

Madoff reportedly told the FBI, the US federal police, that there was no "innocent explanation" for the collapse of his investment scheme.

In 2011, in an interview with The New York Times, he said that banks and funds that negotiated with his investment advisory firm preferred to maintain a "deliberate blindness" in relation to their criminal activities.

"Their attitude was something like, 'If you're doing something wrong, we don't want to know,'" said Madoff, without specifying which companies he was referring to.

Suicide and cancer

In 2011, Madoff's wife said in an interview with American broadcaster CBS that the couple attempted suicide after the scheme was exposed.

Ruth Madoff told the 60 Minutes program that she and her husband took a "lot of pills" of sedatives and medications used to treat seizures and panic syndrome on Christmas Eve 2008.

"I don't know whose idea it was, but we decided to kill ourselves, because what was happening was horrible," she said.

"We took pills and woke up the next day ... It was very impulsive, and I'm happy that we woke up."

The couple's eldest son, Mark, killed himself in his Manhattan apartment in December 2010. His lawyer said at the time that he was an "innocent victim of his father's monstrous crime".

In September 2014, Madoff's youngest son, Andrew, died of cancer at age 48. He blamed the stress of the scandal on the return of the illness he had fought in 2003.

Madoff's eldest son killed himself in his apartment in 2010

'Legacy of shame '

In June 2009, Madoff was found guilty of 11 crimes, including fraud and money laundering.

During the trial, he said he initially expected the scheme to be practiced only for a limited period.

Madoff admitted his guilt before the court and apologized for the "legacy of shame" he brought to his family and the financial market.

"I realized that my arrest and this day would inevitably come," he declared.

When his sentence was handed down, applause and shouting was heard in the courtroom.

' Terrible mistake'

Last year, Madoff requested that his release be brought forward on health grounds, including kidney disease.

In an interview with The Washington Post, he said he "made a terrible mistake".

"I have a terminal illness," he said. "There is no cure for my type of illness. So, you know, I served. I already turned 11 and, to be honest, I already suffered from it."

The judge denied his request, noting that many victims were still suffering due to financial losses.

"I also believe that Mr. Madoff never felt real remorse, and that he just lamented that his life as he knew it was falling apart," said the judge.

The Federal Bureau of Prisons did not specify the cause of his death and said the reason would be determined by a coroner.

No comments:

Post a Comment